The Debt Review Removal Process in South Africa – Your Comprehensive Guide

In South Africa, the National Debt Review Center has developed a structured procedure for the removal of debt review. This method aims to assist individuals in restoring their credit standing and achieving financial stability. The following is a step-by-step guide to comprehend this procedure.

By The National Debt Review Center

The Debt Review Removal Process in South Africa

In South Africa, the National Debt Review Center has established a systematic process for debt review removal. This process is designed to help individuals restore their creditworthiness and regain financial stability. Here’s a step-by-step guide to understanding this process.

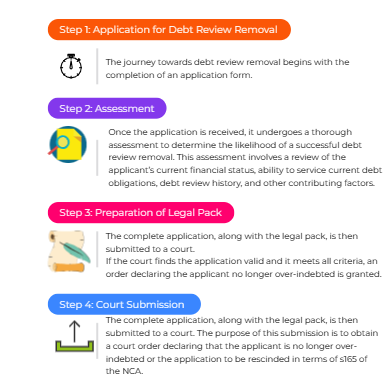

Step 1: Application for Debt Review Removal

- The journey towards debt review removal begins with the completion of an application form. Clients can initiate the process by either booking an appointment or completing an online application form. This form can be filled out online or downloaded, completed, and then submitted.

Step 2: Assessment

- Once the application is received, it undergoes a thorough assessment to determine the likelihood of a successful debt review removal. This assessment involves a review of the applicant’s current financial status, ability to service current debt obligations, debt review history, and other contributing factors.

Step 3: Preparation of Legal Pack

- If the application is deemed potentially successful, a legal pack is prepared. This involves gathering all necessary documentation from relevant stakeholders, which may include previous debt counsellors, credit providers, and other legal entities.

Step 4: Court Submission

- The complete application, along with the legal pack, is then submitted to a court. The purpose of this submission is to obtain a court order declaring that the applicant is no longer over-indebted or the application to be rescinded in terms of s165 of the NCA.

Step 5: Court Order

- If the court finds the application valid and it meets all criteria, an order declaring the applicant no longer over-indebted is granted. This order effectively rejects the previous application for debt review.

Step 6: Documentation Submission to NCR

- Once the court order is granted, the documentation is submitted to the National Credit Regulator (NCR) for updates and verification.

Step 7: Credit Bureau Notification

- After the NCR updates their records to reflect the applicant’s new status, they notify all credit bureaus of the change and request the same update.

Step 8: Credit Profile Restoration

- The applicant’s record with the bureaus will be updated within 21 business days after the NCR’s submissions. The debt review listing will then be successfully removed from the applicant’s credit profile, thus restoring their creditworthiness.

This process, while systematic, requires careful attention to detail and adherence to the steps outlined. It offers a structured path for individuals seeking to remove the debt review from their credit profile and regain control of their financial future.

Frequently Asked Questions

What are some common reasons for rejection during the debt review removal process?

- The application for debt review removal must be filled out completely and accurately. Any missing or incorrect information can lead to rejection.

- The assessment of the application involves a review of the applicant’s current financial status. If the applicant is unable to service their current debt obligations, the application may be rejected.

- Being dishonest and providing misleading information and figures, while intentionally aiming to deceive the debt counsellor or courts, is unethical and illegal.

- The legal pack prepared for court submission requires documentation from various stakeholders. If any necessary documentation is missing or incomplete, this could lead to rejection.

- The court must find the application valid and meeting all criteria to grant an order declaring the applicant no longer over-indebted. If the court does not grant this order, the application is rejected or dismissed.

How can applicants improve their chances of success for debt review removal?

- An increase in income that allows for comfortable repayment of remaining debt can strengthen your case. This could be a promotion, a new job, or additional income streams.

- Paying directly to your credit providers and being up to date.

- Have settled most or some of your accounts that were placed under debt review.

- Are in possession of prescription letters for most or some of the accounts that were placed under debt review.

- Your application is not subject to a debt review court order.

- Providing relevant required documents in a timely manner.

- open communication with your debt counsellor.

What happens if an applicant’s financial status changes during the debt review removal process?

- If an applicant’s financial circumstances improve significantly that they may be able to show that they can meet their debt obligations without the need for debt review. This could potentially strengthen their application for debt review removal. In some instances, consumers will use the snowball effect and settle some of the debts.

- On the other hand, if an applicant’s financial status worsens, it may become more difficult to prove that they can service their current debt obligations. This could negatively impact their application and may lead to a dismissal or withdrawal of their debt review removal application and be advised to continue with debt review with NDRC.

Remember If an applicant’s financial status changes while under debt review, and they fail to meet the agreed-upon terms, such as missing payments, the credit provider has the right to issue a Section 86 (10) notice, withdrawing from the debt review and proceeding with legal action to recover the debt.

It is therefore, important to note that any changes in financial status should be communicated to the debt counsellor as soon as possible.

Download the Debt Review Removal Process Infographic Here

0 Comments